Price Waterfall & Deal Desk: How CPQ Enforces Margin Discipline

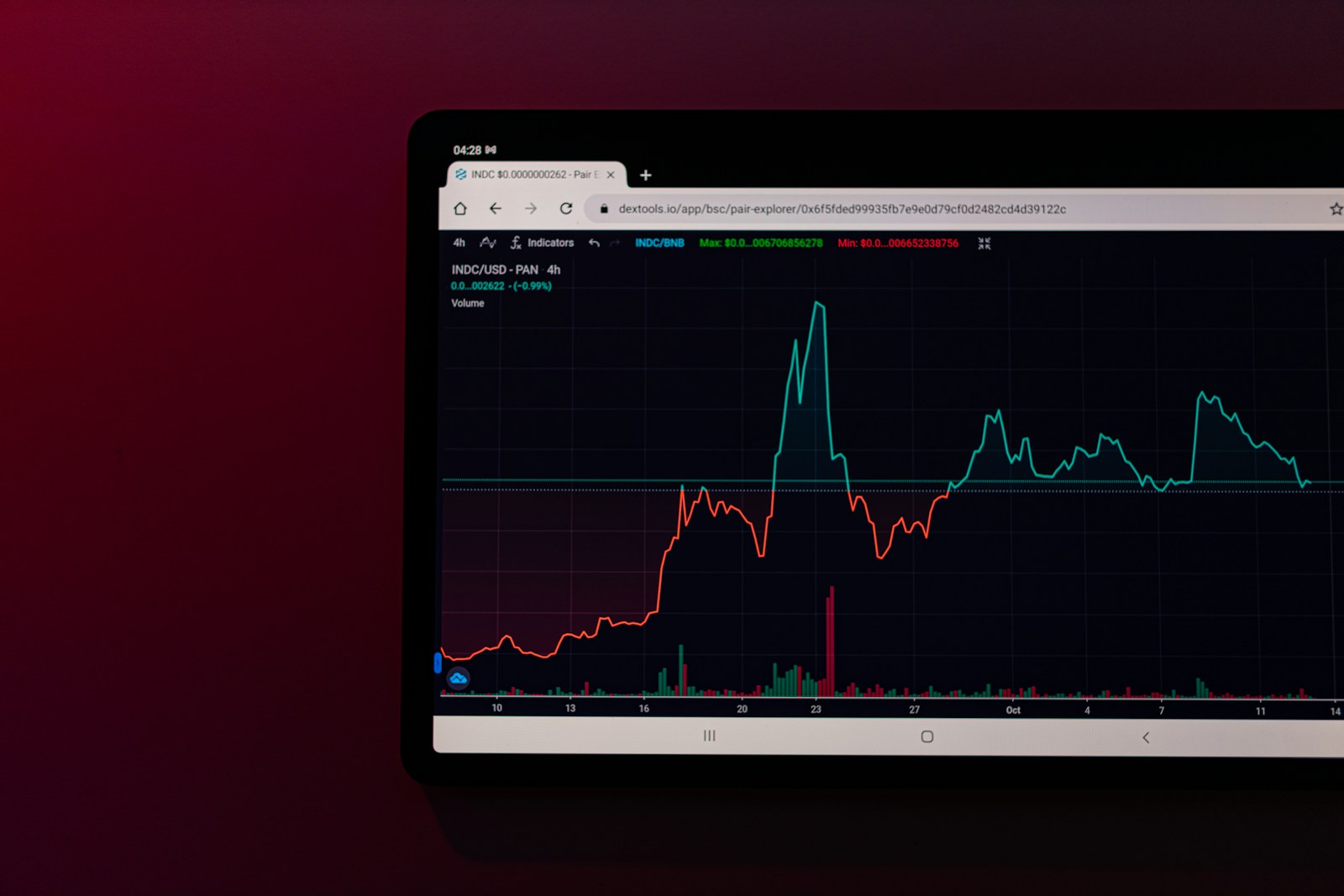

Margin erosion rarely happens in one dramatic step. It happens quietly, discount by discount, exception by exception, until leadership realizes that deal volume is growing but profitability is not.

This is where structure becomes critical. Price waterfall logic and Deal Desk processes exist to make margin visible, controlled, and intentional. Without them, pricing decisions are fragmented across sales teams, spreadsheets, and last-minute approvals.

SAP CPQ plays a central role in enforcing this discipline. It translates pricing strategy into executable rules, thresholds, and approvals that are applied consistently across every deal. Instead of relying on individual judgment under pressure, CPQ embeds margin protection directly into the quoting process.

From my experience, the challenge is not convincing sales that margin matters. The challenge is giving them a system that supports fast quoting while still enforcing financial guardrails. When price waterfall and Deal Desk are operationalized through CPQ, margin discipline becomes part of the process, not a negotiation after the fact.

Price Waterfall Explained

A price waterfall describes how the final deal price is formed, step by step, from the initial list price down to the net price that the customer actually pays.

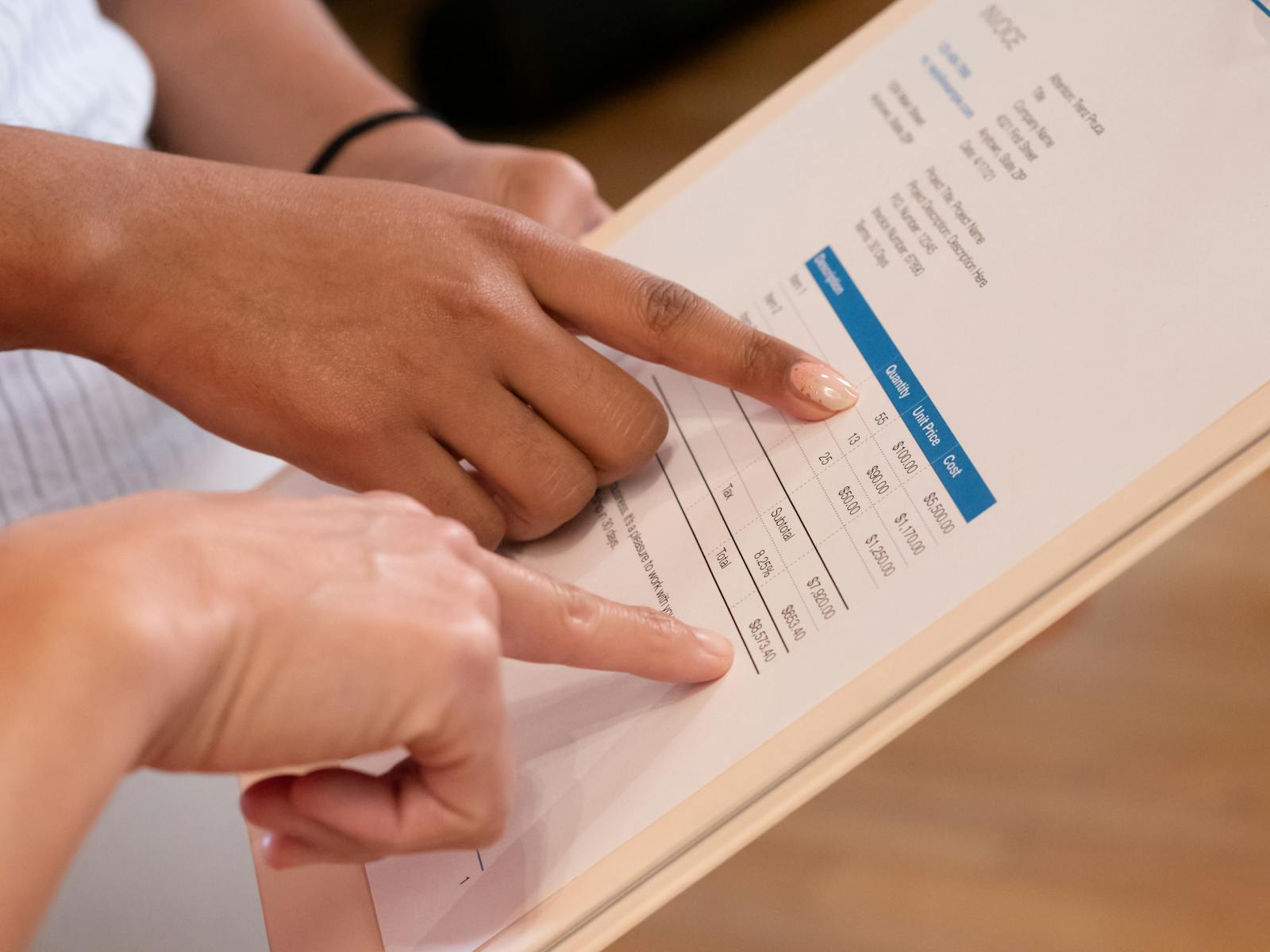

Price waterfall in CPQ makes every margin-impacting step visible. Instead of looking only at the final discount, it shows where value is given away across list price adjustments, standard discounts, discretionary discounts, rebates, and special conditions.

In many organizations, these steps exist informally. Different teams apply them differently, often without full visibility. This is where margin leakage begins.

From List Price to Net Price

The price waterfall starts with a base price and moves through multiple layers of reductions and adjustments.

Each step represents a decision:

- standard pricing rules

- volume-based discounts

- promotional incentives

- deal-specific concessions

Without a structured price waterfall, discounts stack silently and margins erode unnoticed.

Making Margin Impact Explicit

One of the biggest advantages of modeling the price waterfall in CPQ is transparency. Every adjustment is explicit, traceable, and measurable.

Sales teams see how each decision affects margin in real time. Finance gains visibility into where margin is lost across deals and segments. Margin impact is no longer hidden behind a single final price.

This visibility is the foundation for discipline. You cannot control what you cannot see.

Deal Desk as a Control Mechanism

Price waterfall logic shows where margin is impacted. Deal Desk exists to decide when and why those impacts are acceptable.

Deal Desk in CPQ formalizes pricing exceptions instead of letting them happen informally. It creates a clear ownership model for non-standard deals and ensures that margin decisions are intentional, not reactive.

In organizations without a structured Deal Desk, discount decisions often happen under pressure. Sales negotiates, finance reacts, and approvals become inconsistent. Over time, this weakens pricing discipline and creates frustration on all sides.

Exception Handling With Accountability

Deal Desk is not there to block deals. It is there to evaluate exceptions against clear criteria.

Typical Deal Desk responsibilities include:

- reviewing non-standard discounts

- approving deviations from pricing rules

- assessing margin impact and risk

By centralizing exception handling, Deal Desk removes ambiguity. Sales knows when escalation is required, and finance knows that pricing decisions follow a consistent process.

Clear Approval Ownership

One of the most important contributions of Deal Desk is clarity. Everyone knows who can approve what.

Deal Desk in CPQ defines approval ownership instead of leaving it to negotiation. Thresholds are clear, escalation paths are predefined, and decisions are documented.

This structure speeds up approvals while protecting margin, because decisions are made once, consistently, instead of being debated deal by deal.

How CPQ Enforces Margin Discipline

Price waterfall and Deal Desk define the framework, but SAP CPQ is where margin discipline is actually enforced. This is the point where pricing strategy becomes operational instead of aspirational.

Without CPQ, rules exist in presentations and policy documents. With CPQ, they become executable logic applied consistently to every quote.

CPQ margin discipline is enforced through guardrails, thresholds, and automated approvals. These mechanisms remove ambiguity and reduce reliance on manual judgment under pressure.

Guardrails and Thresholds

Guardrails define what sales can do without escalation. Thresholds define when additional approval is required.

In SAP CPQ, these limits are embedded directly into pricing logic. Discounts, margins, and deal structures are evaluated in real time as the quote is built.

SAP CPQ pricing governance ensures that sales flexibility exists only within approved boundaries. When a quote exceeds those boundaries, escalation is automatic and transparent.

Automated Approvals Instead of Negotiation

One of the biggest advantages of CPQ is that approvals are triggered by logic, not by negotiation.

Approval workflows in CPQ ensure that exceptions follow a consistent path. There is no guesswork about who needs to approve what. The system enforces it.

This speeds up deal cycles while protecting margin, because approvals happen early and predictably instead of at the last minute.

Consistency Across Deals and Teams

Margin discipline only works when it is applied consistently. CPQ removes variation between teams, regions, and individual sales approaches.

Every deal is evaluated against the same pricing and approval logic. This consistency makes margin performance measurable and improvable over time.

Where Margin Erosion Typically Happens

Even with a defined price waterfall and Deal Desk, margin erosion can still happen if CPQ is not designed or used correctly. These losses are rarely intentional. They are the result of gaps in structure and enforcement.

Margin erosion most often occurs where pricing decisions escape visibility and control.

Manual Discounts and Overrides

Manual discounts are one of the fastest ways to lose margin. When sales teams adjust prices outside structured logic, decisions are made under pressure and without full context.

Without CPQ enforcement:

- discounts stack unintentionally

- margin impact is not visible in real time

- exceptions become the norm

Manual overrides bypass the price waterfall entirely. This makes margin loss hard to detect until it appears in financial results.

Inconsistent Approval Application

Another common issue is inconsistent approvals. When thresholds are unclear or approvals are handled informally, similar deals receive different treatment.

Inconsistent approval workflows weaken Deal Desk authority and pricing governance. Over time, sales learns which paths are easiest instead of which are correct.

CPQ eliminates this inconsistency by enforcing the same approval logic on every deal.

Late-Stage Concessions

Margin erosion also happens late in the sales cycle, when pressure to close is highest. Last-minute concessions are often made without revisiting the full price waterfall impact.

When CPQ is used correctly, margin impact is visible early, not negotiated at the end. This shifts conversations from reactive discounting to proactive deal design.

Final Thoughts

Margin discipline does not come from policies or presentations. It comes from systems that enforce rules consistently, even when deal pressure is high.

Price waterfall logic and Deal Desk processes create clarity, but SAP CPQ is what makes that clarity actionable. By embedding pricing rules, thresholds, and approvals directly into the quoting process, CPQ turns margin protection into a standard way of working instead of a constant negotiation.

When CPQ is designed correctly, sales does not lose flexibility. It gains guidance. Finance does not slow deals down. It gains visibility and control. Margin decisions become deliberate instead of accidental.

The real value of CPQ-driven margin discipline is scalability. As deal volume and complexity grow, CPQ ensures that margin protection scales with them. That is what allows organizations to grow revenue without sacrificing profitability.