The ROI Math of SAP CPQ: From Cycle Time to Margin Uplift

Let’s not pretend otherwise, when you’re a decision-maker staring down a big digital investment, your first (and totally fair) question is: “What’s the return?”

SAP CPQ might be packed with features, but at the end of the day, it lives or dies by one number, ROI. And that number better speak to hard cash, not just soft potential.

What I’ve seen, over and over, is that SAP CPQ does deliver that return. Often faster than most companies expect. But where things go wrong is in how that ROI is defined and tracked. A lot of teams treat CPQ as a “sales tool” and ignore the finance-led, data-backed thinking that turns features into measurable gains.

So let’s break this down properly. I’ll walk you through where SAP CPQ earns its keep, how to frame its value to stakeholders who care about margins, cycle times, and operating efficiency, and how to track the kind of metrics that actually move a boardroom conversation.

This isn’t a pitch. It’s the business case behind the pitch. And if you’re trying to justify or re-justify your investment in SAP CPQ, or just figure out where the uplift is hiding, this article is for you.

Defining SAP CPQ ROI: More Than Just Cost Savings

Too often, the ROI of SAP CPQ is framed as “we quote faster” or “we reduce errors.” And while those are true, they’re just the starting point.

A real SAP CPQ ROI story has to connect to bigger levers like:

- Shorter sales cycles

- Higher win rates

- Less margin erosion

- Reduced dependency on manual interventions

- And smoother handoffs to downstream systems (like ERP and billing)

For instance, the quote velocity alone, taking a 7-day quote cycle down to 1 day or even 1 hour, can lead to significant revenue acceleration. More quotes means more pipeline. Faster quotes mean earlier decisions. And that means earlier cash in the bank.

If you’ve read our take on why smart companies are doubling down on SAP CPQ, you’ll already know this isn’t just about tech. It’s about operational leverage.

Then there’s the margin uplift. By standardizing pricing logic, improving discount governance, and surfacing cross-sell opportunities, SAP CPQ doesn’t just help you sell faster, it helps you sell better. More margin per deal. Less leakage.

But all of this only counts as ROI if you know how to measure it. And too many teams leave that part fuzzy. If your ROI math doesn’t include KPIs like cycle time, quote-to-cash velocity, average margin per deal, or sales ops effort reduction… you’re missing the real payoff.

Next up, we’ll zoom in on one of the most tangible ROI drivers: cycle time. Because nothing says “we’re serious” like getting a quote out before your competitor even hits reply.

Quote Cycle Time: The Fast Lane to Revenue

Speed isn’t just sexy, it’s strategic. In B2B sales, quote cycle time can be the difference between winning the deal or watching it vanish into a competitor’s inbox.

Before SAP CPQ, many companies rely on Excel gymnastics, tribal knowledge, and three-day email chains just to piece together a quote. It’s a nightmare. I’ve seen teams where the quote cycle stretches out to 7, 10, even 15 business days. By the time the quote’s ready, the client’s interest has cooled or procurement has already found someone faster.

Now flip that. What if your sales team could go from discovery call to configured quote in under a day? Or even better, generate accurate, margin-respecting quotes on the same call?

That’s not fantasy. That’s exactly what SAP CPQ enables.

Let me tell you, cycle time reduction is one of the easiest ROI wins to prove, because it touches everything:

- Sales velocity: reps move through pipeline faster

- Customer satisfaction: prospects love quick, professional responses

- Sales capacity: fewer manual steps means more time selling

- Forecast reliability: quotes are accurate, timely, and structured

In fact, many teams we’ve seen cut their quote generation time by 70% or more. It’s not just about working faster, it’s about eliminating chaos. As we discussed in Quote to Cash Without the Chaos, SAP CPQ brings order to what was once a spaghetti mess of processes.

Even better, when quotes flow faster, cash flows sooner. A cleaner pipeline and faster deal closure directly shorten your time-to-revenue, and that’s music to your CFO’s ears.

And while the fast-quote story is compelling, it’s not the end of the ROI narrative. Next, let’s look at how SAP CPQ does more than just speed, it uplifts margin. Yes, really. Let’s go.

Margin Uplift: Selling Smarter, Not Just Faster

Speed is great. But margin? That’s where the real ROI magic happens.

Here’s the dirty little secret in B2B: most companies bleed margin through their quotes, not their costs. Sales reps over-discount. Bundling logic gets messy. Upsell opportunities are missed. And pricing isn’t consistent, especially across regions or channels.

SAP CPQ doesn’t just automate quoting. It standardizes your pricing discipline and gives your reps guardrails instead of guesswork. That changes everything.

Let’s say you’ve got a sales team that typically discounts at 15% “just to be safe.” With guided selling, SAP CPQ can suggest optimal discount bands, flag excessive cuts, and surface margin-preserving options automatically. Suddenly, reps who used to quote at a 15% discount are sticking closer to 5-8%, and that extra 7% drops straight to your bottom line.

Multiply that over thousands of deals, and we’re not talking pocket change anymore.

SAP CPQ also encourages smarter bundling. Think: attach services to hardware, or auto-suggest tier upgrades that boost deal size. It’s a shift from “just get the deal done” to “get the right deal, profitably.”

We covered how discounting pitfalls hurt profitability in our piece on sales bottlenecks, and SAP CPQ is one of the few tools that actually closes those leaks.

Beyond the numbers, there’s a confidence boost too. Reps don’t need to second-guess every quote or beg for approvals. Managers sleep better knowing margins are protected. And finance? They finally see consistent deal economics.

So yes, SAP CPQ shortens cycles. But its ability to protect, and even increase, margin is what makes it a real revenue weapon.

Next, let’s tie this to something tangible: which KPIs actually tell the story of success.

Strategic KPIs That Prove CPQ Works

If you’re going to talk ROI, you need the right scoreboard. SAP CPQ can do a lot, but unless you’re tracking the right KPIs, you’ll never know just how much it’s helping, or where to push harder.

Let’s break down the core metrics that smart companies watch after implementing CPQ:

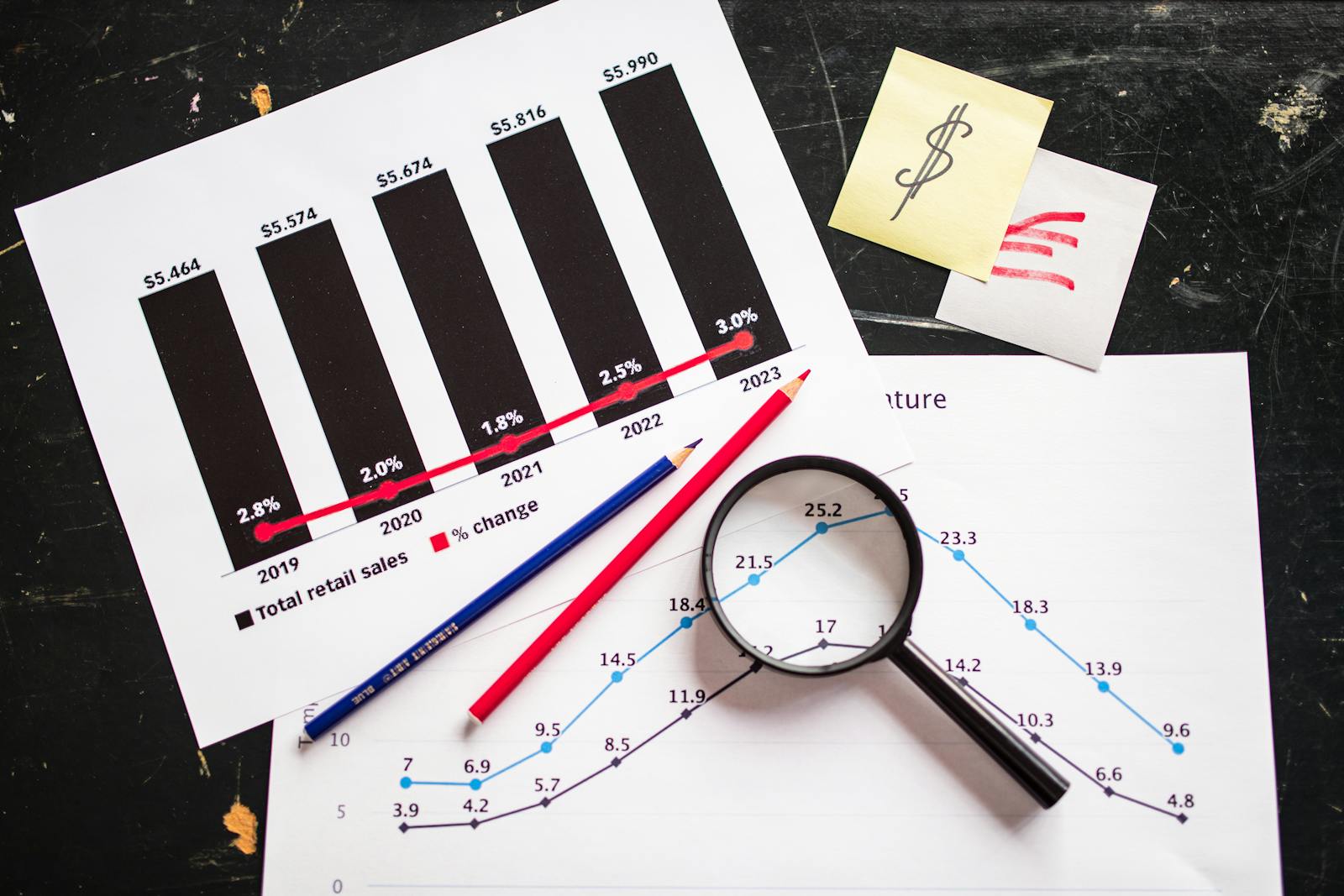

1. Quote Cycle Time (QCT)

This one’s a favorite, and for good reason. It shows how quickly a quote moves from request to delivery. The shorter the cycle, the faster your revenue potential.

📉 Before CPQ: 7–10 days

📈 After CPQ: 1–2 days or even under an hour in some setups

2. Quote Volume per Rep

CPQ automates grunt work. That means your reps can generate more quotes in less time. Keep an eye on this metric to quantify productivity gains.

3. Average Discount Rate

Want a live view of margin erosion? Track your discount rate per deal or per rep. After CPQ, this number should start to tighten, as discounting becomes governed by rules, not gut feeling.

4. Win Rate / Close Rate

When quotes are faster, clearer, and more accurate, deals close more often. You should see a measurable bump in win rate, especially in competitive situations where speed and clarity matter.

5. Quote Accuracy / First-Time Approval Rate

A classic pre-CPQ headache: quotes bouncing back from finance or legal. Post-CPQ, those errors vanish. Use this KPI to measure how clean your quotes are from the get-go.

6. Revenue per Salesperson

This is the big one. With all of the above working, each rep should be closing more and better deals. If that number’s not moving, you’ve got a deeper adoption issue.

And don’t sleep on how SAP CPQ removes friction. Reduced manual touchpoints, fewer handoffs, and less “where’s that spreadsheet” time all roll into these metrics, even if they don’t show up on a dashboard right away.

Want a deeper dive into how automation boosts KPIs? We unpacked this further in Top 5 Benefits of Automating Your Sales Quotes.

Remember: what gets measured gets optimized. If you’re not already tracking these KPIs post-implementation, start now. They’ll be your best defense (and offense) in any ROI conversation.

Next up, let’s talk about soft wins. Because not everything that matters shows up in a spreadsheet.

Hard ROI vs. Soft Wins: What to Track and How

We’ve covered the metrics you can plug into a dashboard. But not every win fits neatly into a spreadsheet. Some of the most valuable outcomes of SAP CPQ show up in quieter, but no less meaningful, ways.

Let’s unpack both sides of the ROI coin.

Hard ROI: The Numbers That Make CFOs Smile

These are the outcomes that are easy to quantify and defend:

- Reduced quote cycle time

- Increased revenue per rep

- Lower average discount rate

- Fewer errors and rework in quote approvals

- Higher win rates and faster deal velocity

They’re clean. They’re measurable. And they make your business case look bulletproof.

But only tracking the hard stuff? That’s like measuring a plane’s speed but ignoring lift. You’ll miss out on critical insights.

Soft Wins: The Hidden Value That Powers Teams

Here’s what the spreadsheets don’t show, but leadership still feels:

- Sales rep confidence

Reps stop second-guessing product rules or pricing logic. They trust the tool, and that leads to better calls and stronger pitches. - Happier customers

Fast, accurate quotes build credibility. You look like a company that’s on top of its game, not one cobbling together PDFs at 11pm. - More strategic sales management

Managers spend less time firefighting approvals and more time coaching deals. - Alignment across teams

When CPQ is fully integrated (with CRM and ERP), marketing, sales, finance, and fulfillment finally speak the same language.

These “soft” improvements often become the backbone of long-term ROI. They reduce churn. Increase rep retention. Strengthen brand perception.

We touched on this human factor in Why SAP CPQ Is the Missing Piece in Your Sales Puzzle, and it still holds true: the tech only works if the humans trust and embrace it.

So when building your ROI narrative, don’t stop at margins and cycle time. Add the lift you feel, not just the numbers you see. Your leadership team will thank you.

Making Your Business Case Bulletproof

You’ve got the numbers. You’ve got the operational wins. Now it’s time to package it all into a case leadership can’t ignore.

Whether you’re proposing SAP CPQ for the first time or trying to expand its footprint, your business case needs to hit three key notes: urgency, clarity, and confidence.

1. Start with the problem, in dollars, not feelings

Avoid vague phrases like “sales inefficiency” or “manual work is frustrating.” Frame the pain in financial terms. For example:

“Our average quote cycle is 6.5 days. That delay costs us an estimated €420K per quarter in stalled revenue and lost deals.”

Numbers like that wake up decision-makers.

2. Anchor your case in measurable outcomes

Use the KPIs we discussed earlier, cycle time, discount rate, win rate, and apply them to your existing performance. Then model what even modest improvements could mean.

If your average deal size is €50K and you close 20 deals a month, shaving just 5% off your discounting can recover thousands in margin per rep. That’s the kind of math that sticks.

3. Add credibility with supporting evidence

Mention peer benchmarks, case studies (anonymized is fine), or third-party insights. And absolutely include internal validation, like a small pilot or feedback from your sales team.

Bonus points if you reference tools like SAP CPQ ROI dashboards or insights from previous posts like Quote to Cash Without the Chaos.

4. Address risk, then squash it

Executives expect you to surface risk. But they’ll trust you more if you show how you’ll manage it. Things like:

- Clear integration with existing SAP landscape

- Structured onboarding and training timeline

- Internal CPQ champions or superusers already identified

Mentioning these shows you’re not just dreaming, you’re planning.

The goal here isn’t to make CPQ look perfect. It’s to make it inevitable, the logical next step if the company wants to grow smarter, not just bigger.

Now let’s wrap this up and zoom out to the big picture.

Final Thoughts: Don’t Leave Money on the Table

Here’s the honest truth: most companies underestimate what SAP CPQ can do, not because the software is unclear, but because the impact is.

It’s easy to see CPQ as a sales ops upgrade. A nice-to-have. Something that helps generate quotes faster. But what it really is? A margin amplifier. A cycle-time killer. A visibility engine. A platform that aligns product, sales, finance, and operations around one shared goal: revenue growth with control.

And the ROI? It’s not a fantasy. It’s right there in your quote cycle time, your margin rates, your close velocity, your rep productivity. The trick is to measure it like a CFO and optimize it like a sales leader.

If you’ve been tracking the chaos of manual quoting, slow approvals, inconsistent pricing, or missed upsell chances, you’re not alone. We unpacked those exact problems in The Hidden Cost of Doing Sales the Old Way. They’re expensive, and they add up.

But CPQ is your way out. Your ROI lever. And as we said in The ROI of SAP CPQ, smart companies are doubling down, not because they like shiny tools, but because they see the numbers move.

So no, don’t leave money on the table. Don’t wait for “next quarter.” Don’t settle for one more slow quote or leaky margin. With the right approach, SAP CPQ doesn’t just pay for itself, it funds your growth.

And if you’re wondering how to kickstart that process? Well, you know where to find me 😉